Original article from: USA Today

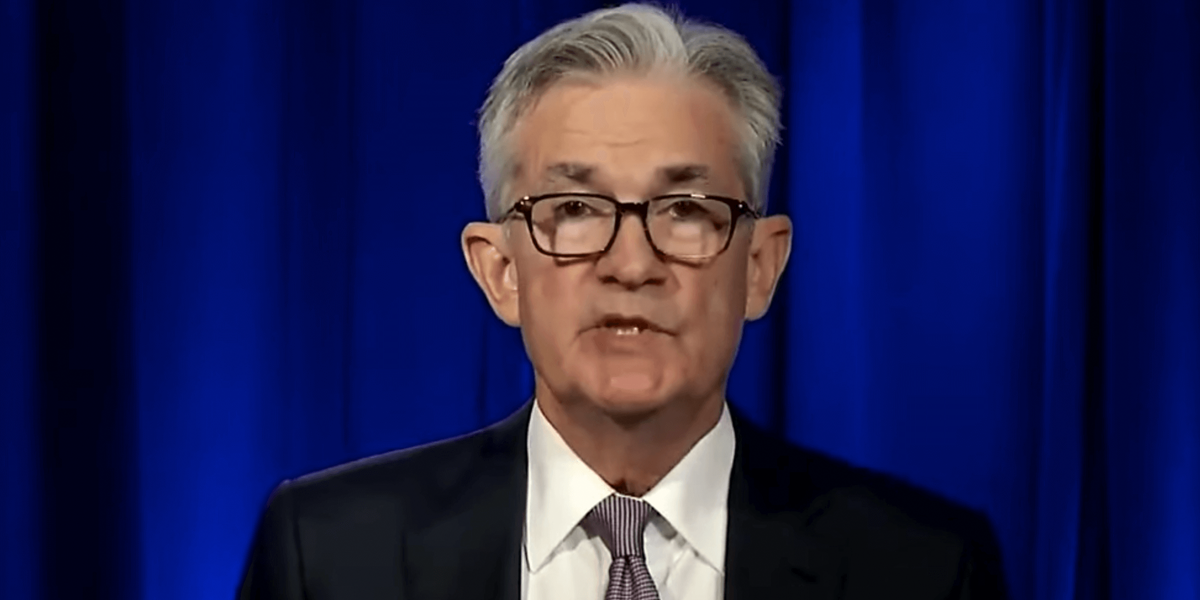

Federal Reserve Chair Jerome Powell urged Congress on Tuesday to pass a robust stimulus, saying that providing inadequate support would weaken the recovery from the coronavirus recession while “overdoing it” would only strengthen the rebound.

“Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses,” Powell said in a speech at a virtual annual meeting held by the National Association for Business Economics. “Over time, household insolvencies and business bankruptcies would rise, harming the productive capacity of the economy, and holding back wage growth.”

LEFT VIEWPOINTS

Trump ignores the Fed and abandons unemployed households.

- The Fed has said, over and over, America needs robust stimulus. They can print money, but if the government doesn’t know how to spend it, it will not help the economy recover quickly.

- The House passed a robust stimulus plan. The Republican Senate refused to move forward on it, and Trump said he won’t do anything with it until after the election.

- Trump will encourage the Republican Senate to spend the rest of the month trying to confirm Amy Coney Barrett to the Supreme Court instead of fighting to help the country.

- The priorities for the Republican Party are completely out-of0touch with what America needs.

More than 11 million people are now unemployed. This afternoon, Trump announced that he will not negotiate with Democrats on a stimulus plan until after the election. It’s the latest in a string of selfish, irresponsible actions from a President who caused the mess our country now finds itself in.

Let’s go back and review Trump’s inadequate response to the pandemic.

The economy is more than the stock market. The stock market is a poor indicator of the health of the economy. We’ve seen firsthand how the stock market can go up even though the economy is way down. When the Fed pushes interest rates to zero and prints trillions of dollars, the stock market goes up. The following video was put out just before the coronavirus pandemic.

The economy is more than the stock market. The stock market is a poor indicator of the health of the economy. We’ve seen firsthand how the stock market can go up even though the economy is way down. When the Fed pushes interest rates to zero and prints trillions of dollars, the stock market goes up.

As long as the Fed keeps printing this much money and interest rates stay at zero, the stock market will continue to rise. But without the government doing their part, the real economy won’t benefit. Businesses will fail by the thousands, and when a business fails, it doesn’t just start up again. The market may not be suitable for a new business to take over. It can remain a hole in the economy that may go unfilled for many years — perhaps indefinitely.

It’s sad knowing that our country could be in a much better place today, had Trump lost the election. The pandemic would have still hit us, but it is unlikely that any President could have handled this as poorly.